Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Get paid faster when you set up direct deposit with Chase. Here's how to get started below, plus how long it takes to get your money.

Direct deposit is a popular, convenient and secure way to send or receive payments. If you're not already enjoying direct deposits with Chase, stick around. Below, find out how to set it up and how long it will take to clear funds.

|

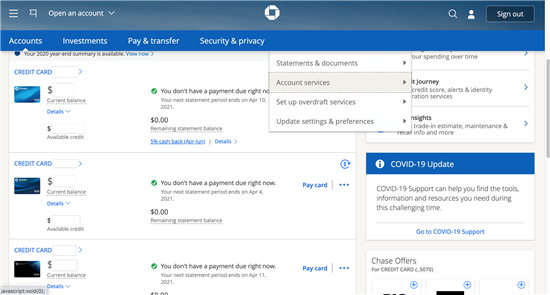

| Screenshot of Chase |

|

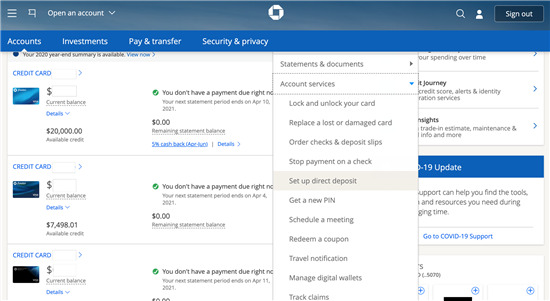

| Screenshot of Chase |

|

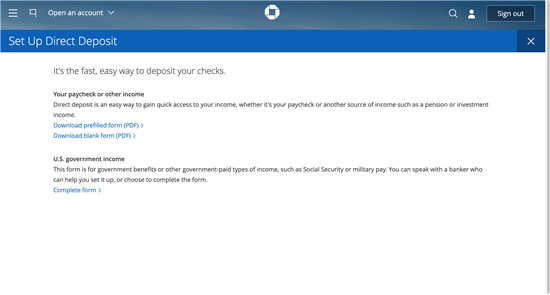

| Screenshot of Chase |

Direct deposit may take up to two pay cycles to start after you submit the Chase direct deposit form to your HR/payroll department

How do you know if Chase Direct Deposit is set up?

Reach out to your HR or payroll department to confirm. Once they verify it's been set up, you can log into your Chase account online or with the mobile app to see when the direct deposit hits your account.

Direct deposits usually hit your bank account immediately. And direct deposit funds are available on the same business day that they're sent to the bank. Generally, Chase prioritizes all deposits including direct deposits before processing withdrawals, purchases and other transactions.

Does Chase process direct deposits on weekends?

All banks, including Chase, must make your deposit available by the next business day, after it receives funds. So, if your employer initiates a payment on Saturday or Sunday, it will hit your account on Monday. Does Chase Offer Early Direct Deposit?

Chase does not offer early direct deposit. Direct deposit payments will be available the same business day they're made.

Taking a few minutes to set up with direct deposit gives you quick and easy access to your cash. Plus, you don't need to wait around for your check in the mail. Time to get rid of physical checks - once and for all. You can enroll in direct deposit with a Chase checking account. If you don't have a bank account with them yet, take a look at their current Chase coupons and bonus codes.

To qualify for Bonus: Apply for your first Discover Online Savings Account, enter Offer Code CY624 at application, deposit into your Account a total of at least $15,000 to earn a $150 Bonus or deposit a total of at least $25,000 to earn a $200 Bonus. Qualifying deposit(s) may consist of multiple deposits and must post to Account within 45 days of account open date. Maximum bonus eligibility is $200. What to know: Offer not valid for existing or prior Discover savings customers, including co-branded, or affinity accounts. Eligibility is based on primary account owner. Account must be open when bonus is credited. Bonus will be credited to the account within 60 days of the account qualifying for the bonus. Bonus is subject to tax reporting. Offer ends 09/12/2024, 11:59 PM ET. Offer may be modified or withdrawn without notice. See advertiser website for full details.

Member FDICAmber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.